An Ontario company is creating a database of "positive and negative tenant behaviour,” raising concerns about privacy and potential blacklisting — as well as conflicts of interest, as the company's CEO is a director at a property management company with tenants who say they've been signed up without consent.

Landlord Credit Bureau describes itself as a "carrot and stick" service, where residential landlords can sign up and review their tenants, whose credit scores will then be impacted — positively or negatively — by their rent payment behaviour.

"We are essentially a central repository of tenant records. So landlords are able to register their tenants with us, and then report their monthly payment habits. So, did they pay on time, did they pay late, or did they not pay at all?" LCB's CEO, Zachary Killam, said on an episode of real estate podcast Property Profits in January. "Then, in addition to that, they can share reviews about their experience with that tenant. And so then this all forms part of the tenant resume, or the tenant record, which is then accessible to future landlords when they're looking at an application to potentially rent out their unit to an individual."

If a tenant has never been late on rent, the landlords can add their profile to the site for their own record-keeping, after which the tenant can opt-in to be included in the central database.

But if they owe rent, the landlord can add a tenant to the central list without their consent, Killam said.

He noted that consent is required before a future landlord can look at a tenant’s records.

The “carrot and stick” arm of LCB works by placing a trade line on tenants' credit scores through Equifax, Killam said — meaning that if a tenant pays their rent on time, their credit score goes up. If not, it goes down.

No consent is required for late payments to be recorded with Equifax.

A list like this "raises a lot of concerns about privacy and personal information," NDP tenant rights critic Jessica Bell said.

LCB is “running a bad tenant list,” she said in a letter urging the federal Office of the Privacy Commissioner (OPC) to look into the company.

She said she’s concerned landlords could negatively review tenants if they speak a different language or ask for repairs, she said.

For instance, a landlord review about a "strong food odour" from a tenant "could be masking ... 'We don't like people from a certain country,'" said Douglas Kwan, the director of advocacy and legal services for the Advocacy Centre for Tenants Ontario. "Which we've seen before in human rights cases."

The database heightens the power imbalance between tenants and landlords — "‘Don’t cross me or I’ll put you on the blacklist’” — said Benjamin Ries, a housing lawyer with Downtown Legal Services at the University of Toronto.

Killam said LCB takes a number of steps to prevent discrimination: it doesn’t allow anonymous reports; users contractually agree to be non-discriminatory and are “warned” not to be “emotional” before they write a review; reviews are screened by LCB’s support team for things like “foul language” and “personal attacks”; and tenants can access their own records and are “easily” able to dispute them.

“Blacklists are illegal, LCB is not a blacklist,” Killam told QP Briefing via email. “LCB operates a registered consumer reporting agency. LCB provides a formal and regulated mechanism and is improving the accessibility and transparency of the rental ecosystem which we hope will eliminate the unfair and illegal blacklists in existence.”

Housing Minister Steve Clark did not respond to a request for comment. The ministry directed questions about privacy to the OPC.

Killam a director at property group that uses his company

Landlord Credit Bureau’s CEO sits on the board of Live Well Property Management, which owns properties in the Greater Toronto and Hamilton Area and has used LCB. His overlapping interests have raised concerns among some experts about conflicts of interest between him and his tenants.

“What would we think if we found out that a credit card company owned Equifax or TransUnion?" Ries said. "It’s a trusted role in our society."

Killam said he has “not been actively involved in management” since 2018, though on Property Profits in January, he referred to himself as a “landlord.”

He said he would recuse himself in a dispute between a Live Well tenant and LCB.

“My interest in a small number of rental units is not comparable to what’s been suggested,” he told QPB.

Some of Killam’s tenants have come into conflict with his LCB service.

David Pace-Bonello, a Live Well tenant in Hamilton, has asked Matt Christie — who sits on the board of Live Well with Killam — to stop sharing information with LCB.

Christie eventually agreed, though not before noting that he didn’t need Pace-Bonello’s permission to open a file on him with LCB.

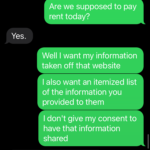

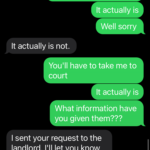

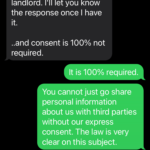

In a text dated May 1, 2020, Pace-Bonello tells Christie he didn't consent to have his information shared, to which Christie replies, "Consent is not required."

- Texts with Matt Christie, provided by David Pace-Bonello.

- Texts with Matt Christie, provided by David Pace-Bonello.

- Texts with Matt Christie, provided by David Pace-Bonello.

In an email dated June 9, 2020, Christie agrees to delete the LCB record, but warns that he may use the service again.

"We will remove the positive record we have created for you, but if rent goes unpaid after its due date in the future we may use Landlord Credit Bureau again," Christie said.

Live Well had opened a record with LCB including the couple’s names, email addresses, move-in dates, address, rent amount and the fact they had no balance owing at the end of March, April, May and June, Christie told Pace-Bonello in another email viewed by QPB.

Christie told QPB that Pace-Bonello’s and Nicol’s personal information “was not shared with third parties,” suggesting Live Well used LCB's internal record-keeping service for the couple. He maintained that LCB and Live Well are separate entities.

Killam said Christie is not involved with LCB.

A close relationship between a consumer reporting agency for landlords, and the landlords themselves, was a specific concern of Kwan's.

"You have a landlord who [can] quite conceivably say, 'Well, if you're not paying your rent I’m going to report you to my own reporting agency,'" he said.

Killam noted that landlords have always been able to report rent debts to credit bureaus and said LCB “actually creates a stronger relationship between landlords and tenants.”

Bell said she’s spoken with a paralegal who primarily represents landlords, who reached out because he was concerned with his clients adding tenants to LCB without their consent.

“It’s pretty concerning when you hear the same concerns raised by a completely independent person who represents landlords," she said.

Tenants face lawsuit after pushing back

Pace-Bonello said he and his partner, Joey Nicol, found out that they had been signed up for LCB when they received a "creepy" welcome email in March 2020, at the beginning of the pandemic.

"It didn't sit well with me," Nicol said.

Nicol said she emailed her MP, the NDP's Matthew Green, and her MPP, Ontario NDP Leader Andrea Horwath, and got "ping-ponged" between them. (She and Pace-Bonello connected with tenant rights critic Bell after QPB reached out to her for this story).

Nicol and Pace-Bonello also emailed the federal privacy commissioner. Bell’s letter to the OPC urges the office to follow up on the tenants’ requests.

Getting nowhere, the couple set out to warn other tenants about what they saw as a privacy risk.

"There's people whose English isn't great, who are getting an email and probably not understanding their rights," Pace-Bonello said. "No one has the time to spend hours [researching], unless you’re some kind of maniac like me."

So, over the summer, he said he printed some flyers about LCB and left them in mailboxes of Live Well buildings.

He also started a blog, where he answered questions he thought tenants might have — like, "What if I don’t want the Landlord Credit Bureau to collect and share my personal information anymore? Can I get them to stop?"

After a slow start, emails from tenants who had been signed up for the service started coming in the fall, he said.

"I think what a lot of them were ultimately looking for was, they were freaked out. They're really scared because they're not sure what's going to happen to their homes," he said.

Then came the takedown notice. LCB said screenshots of its site that Pace-Bonello used on his blog were copyrighted, he said. The screenshots were taken from the landlord section of the site, which he said he signed up for to see if he could find his own records.

Screenshot of a previous version of Landlord Credit Bureau website via David Pace-Bonello. LCB says it no longer uses the phrase "good or bad tenant list."

The site takes a "different tone" back there, he said.

“It’s a lot more, 'We’re going to get these people for you, you know, you’re gonna be able to punish them," he said. "It's really explicit."

Killam said the site’s marketing copy “is constantly evolving to better inform and clarify for our customers.”

He added: “Limited screenshots can be used to avoid context and hide the balance of overall features and messaging.”

Pace-Bonello's screenshot of the landlord section, which he shared with QPB, says the service "helps good tenants, harms bad tenants," near what appears to be an illustration of a cartoon robber.

"As landlords we can't rely on tribunals or courts or tenancy laws to protect our business," it reads.

"We have to protect ourselves."

Pace-Bonello said he removed the images, but was then served with a suit saying the blog was defamatory — which he also published on the blog.

He said he's applied to dismiss the suit, which was filed in British Columbia, under the province's legislation preventing strategic lawsuits against public participation (SLAPP).

Killam said Pace-Bonello and Nicol “have been spreading false information about LCB guised as legal advice and are using innuendo to create a false narrative,” and haven’t reached out to the company “to actually understand how LCB works.”

He said Pace-Bonello’s site published the address and picture of a property manager’s personal home “who they then clearly expressed they don’t like. This shows malicious intent and is not fair comment.”

He noted that they only revealed their identities when they had to in order to dispute the takedown notice.

Pace-Bonello said he hasn't spoken to any lawyers and plans to represent himself, if it comes to that.

“I’m a very cynical person, as a whole, but when you're in a position like this, what you ultimately end up having to believe is that this is a system designed for normal people to use," he said.

Experts say LCB out of step with spirit of the law

Whereas attempts at "bad tenant lists" have been slapped down by the federal privacy commissioner in the past, LCB says its strategies are legal because it is a registered consumer reporting agency in Ontario — like Equifax and TransUnion, which handle credit reports.

The company also maintains that its list is legal because it includes both positive and negative tenants — not just negative.

Screenshot via landlordcreditbureau.ca.

“Allowing the option for landlords to document ‘good’ as well as ‘bad’ tenant behaviours does not change the impact on tenants deemed ‘bad,’” said Brenda McPhail, the director of the Privacy, Technology & Surveillance Project at the Canadian Civil Liberties Association.

Killam said LCB has stopped using the phrase “the good or bad tenant list” in reference to its database, “as the words ‘good’ and ‘bad’ are subjective and our records provide facts, not subjective conclusions.”

The issue "lives in the gaps" between laws enacted at different levels of government, Ries said. "I think it’s kind of scary for tenants that they maybe don't know who exactly is responsible here."

Killam disputed this reading.

“The issue of privacy and consent under LCB does not ‘live in the gaps’ between laws, and our team closely monitors and fully understands the laws that exist at all levels of government,” he said.

Kwan said he was "curious" whether checks and balances were followed when LCB received its license on April 2, 2020. "To my understanding, it’s not an arm’s-length type of relationship," he said, referring to Killam’s overlapping interests.

“LCB was created years before I was aware of or joined the organization,” Killam said.

On its site, the company says there have been no successful legal challenges against it or any of its users. It says it will handle legal defences for "Premium Plan" users.

The federal privacy commissioner said it has received four complaints about LCB. Three were closed without a finding, meaning there wasn't a full investigation, spokesperson Vito Pilieci said. One complaint remains open, but Pilieci said he couldn't share any details.

In general, legislation requires "meaningful consent" to collect, use and disclose personal data, he said, "for purposes that a reasonable person would consider appropriate in the circumstances."

Ries questioned whether boilerplate phrases on leases, such as those LCB supplies, comply with the "meaningful consent" part.

"Does the tenant really understand what they're agreeing to when they sign?" he said.

On Property Profits, Killam said landlords don't need debt-owing tenants' consent to sign them up for the service, because, as a consumer reporting agency, LCB can collect debts, investigate a lease breach, or detect, suppress or prevent fraud.

Though debt-free tenants have to opt-in to be included in the database, "if at any point in the future they decide to be delinquent and to stop paying you, now you no longer require consent — so instantly, that record is going to start reporting a trade line on their credit report with Equifax," he said.

McPhail said it’s “deeply problematic that the organization is counselling potential customers that tenant consent is deemed unnecessary after one late rent payment, particularly when the sharing of the information could have significant impacts on the individuals.”

Under the spirit of the law, “the greater the risk of harm from disclosure, the higher the consent threshold should be,” she said, pointing to the OPC’s previous anti-bad tenant list decision.

“Disclosing to a credit bureau is of course a primary and widely used method to collect debts and thus is reasonable and appropriate as well as a formal and regulated mechanism,” Killam told QPB.

“The landlord can show on their tenant record that the payment was late, however debts are not disclosed until after they have remained unpaid for a minimum of 30 days.”

Kwan noted that LCB's licensed status distinguishes it from Naborly, another tenant screening service, which faced backlash after asking landlords whether their tenants had paid rent in April, 2020, as the pandemic ravaged the world. (Naborly's CEO has said this was a misunderstanding).

Killam maintains service is good for most tenants

Killam told QPB that LCB’s impact on over 90 per cent of tenants registered is positive, including young people, new immigrants and people with poor credit who pay rent on time, as it helps them build their credit score and opens up more and better options for rentals in the future.

“The small percentage of tenants who choose to be delinquent cost the rental housing industry over $3 billion per year in Canada which impacts the housing supply for everyone,” he said.

He told Property Profits LCB has about 34,000 landlord and property management members, as well as "tens of thousands" of tenants signed up across Canada and the United States.

Ontario has 45 licensed consumer reporting agencies, according to the Ministry of Government and Consumer Services — but Kwan said LCB is the only one he knows of that caters specifically to landlords.

"The concern is, when you have an affordable housing issue prior to the pandemic, and then you mix that with the results of the pandemic, with high unemployment, and then now you have this, it’s just something that is going to be so much more difficult for tenants to find a home and stay at home safe, and prevent a third wave from happening," he said.

He told QPB the company allows COVID-specific rent deferral and payment plans to be registered, which can also help tenants.

On Property Profits, Killam said LCB’s carrot-and-stick approach is “particularly relevant” in areas with COVID-19 eviction freezes.

Couple now faces eviction

Pace-Bonello and Nicol received an eviction notice on March 4. It filed almost a year earlier, before they had raised concerns about LCB and Live Well, but it only just arrived.

Live Well alleges the couple was between one and four days late with their rent, four times in 2019 and 2020.

N8 form via David Pace-Bonello.

Nicol said it’s never been a major problem in the past. Sometimes, they’ve received rent reminder emails from Live Well after they’ve sent it, because the company hadn’t deposited the e-transfer yet, she said.

“We were in communication for a long time, like, oh, Dave's payday would fall on the fourth, or the second, or something. We are both low-income, working people. If we miss a paycheque, we're in trouble, kind of thing," she said. "So it happens sometimes to us. But we always pay it. We don't have arrears."

Christie did not respond to questions about the couple’s rent payment habits.

Pace-Bonello noted that Christie said later in March, after the notice was first filed, that the couple had "no reason to be worried” about being signed up for LCB.

"...you always pay your rent on time and when you login to LCB you will see that's what has been recorded for you," Christie wrote in an emailed response to Nicol’s concerns, which was viewed by QPB.

The eviction notice the couple received on Thursday was signed by Jake Gutmann, who worked for Live Well and LCB for months simultaneously last year, according to his LinkedIn page.

Killam said Gutmann became an LCB employee on May 13, 2020.

“I believe he was doing some voluntary product testing prior to that. In any event, there was never a conflict of interest. Jake was hired for a business development/sales role at LCB,” he said via email.

Gutmann also appears to have advertised LCB while implying that he doesn’t work for the company.

“A co-worker of mine recently told me about Landlord Credit Bureau,” a user with the same name posted on BiggerPockets, a landlord forum. “Seems like they have desirable opportunities for both landlords and tenants that use the service. Has anyone else here tried using it?”

Gutmann declined to answer questions about his time at LCB.

Screenshot via biggerpockets.com.

Bell said she worried the couple wouldn’t get a fair shake at the tribunal because of how fast it’s running through eviction processes.

"A lot of these proceedings are taking place online at a speed that might not allow an adjudicator to do all the research that they need to do to make sure it's a fair eviction hearing," she said.

‘I don't want to leave here’

The couple is in trouble if they lose their home of nearly 20 years — rent has doubled for a unit of their size since they moved in, Nicol said.

"I'm literally terrified right now," she said. "Because I don't have a job right now. Dave's the one supporting us."

Nicol started to cry.

“I love our apartment. I love our neighbours. I love our neighbourhood. I don't want to leave here, you know? This is our community. And to have these people not from here come and make it impossible for us to live in the city that we're working in, it's really hard,” she said.

“I just want to live and be happy."

Leave a Reply

You must be logged in to post a comment.